About Land Tax

What is land tax?

Land Tax is an annual (calendar year) tax based on the total site (unimproved) value of all non-exempt land you own in Victoria. It includes investment properties, commercial properties, holiday homes and vacant land. Annoyingly, covenanted land is considered “vacant land” or a “holiday home”. Land Tax is imposed by the State Revenue Office.

Disclaimer

Exemptions from land tax

There are several categories of land exempt from land tax. The most common exempt categories are:

- your principal place of residence (PPR). But remember generally you can only claim one PPR in Australia and it must be continuously used for six months of the assessment year, or

- primary production land (PPL). Several covenantors have reported an unexpected Land Tax bill when they placed a covenant on their property because the PPL exemption no longer applies to the land.

More detail is in this Ruling.

What does the SRO say about Principal Place of Residence and Primary Production for covenanted properties?

In 2022, we asked the SRO several questions about the interface of covenanted land with the Principal Place of Residence and Primary Production exemptions. These responses generally still apply for non-exempt covenanted properties (i.e. those that do not have a TfN covenant). You can view their response here.

More exemptions are listed on the SRO website.

Land Tax exemption for covenanted properties from January 2024

But not all covenanted properties...

Only properties with a Trust for Nature covenant are exempt from land tax. Other forms of conservation covenant are not exempt from Land Tax assessment. This includes properties with a S.69 (DEECA) Agreement under the Conservation, Forests and Lands Act or a S.173 (local government) agreement under the Planning and Environment Act.

Land Covenantors Victoria strongly disagrees with this approach. We believe that all properties with a permanent conservation covenant registered on title should be exempt from Land Tax. We will continue to lobby the Victorian Government to achieve this.

Other things to note are:

- Only the portion of the property subject to the TfN conservation covenant is exempt under the conservation property exemption.

- The Land Tax exemption only applies from the 2024 calendar year. If you have a historical Land Tax debt, the State Revenue Office may still contact you to recover the debt.

Applying for the conservation covenant exemption from Land Tax

It is important to remember that, even if you have a TfN covenant, you must apply for the exemption. Please do not assume that the State Revenue Office will automatically apply this exemption to your covenanted property.

Land Tax obligations are currently managed through the My Land Tax portal. This is where you apply for an exemption or lodge an objection to a valuation.

You will need to provide:

- your customer number

- property address

- details of what the land is used for e.g. your home, primary production land. If it is used for more than one activity, please tell the SRO about them all

- a copy of the conservation covenant entered into with Trust for Nature

- the percentage of land that is protected under the conservation covenant.

You can contact Trust for Nature if you need a copy of your conservation covenant or other details.

Increases in Land tax - What does COVID have to do with Land Tax?

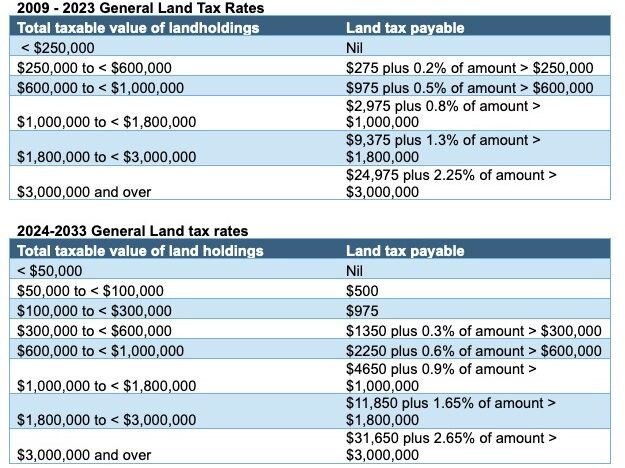

As part of the COVID debt repayment plan, from the 2024 Land Tax year, there has been an increase of Land Tax rates and a lowering of Land Tax thresholds. These changes apply from now through to 2033. This may be why some covenantors are receiving a land tax bill for the first time.

Changes to Land Tax rates and thresholds

Check out the tables below or find out more about current land tax rates here.

(Note: For most of us, the general rate applies, however for land held on trust a surcharge rate applies. There is also an Absentee owner surcharge that applies if there are foreign interests in the land.)

Valuations for Council rates and Land Tax

Land tax is calculated based on the site value (unimproved) of all non-exempt properties at 31 December of the previous calendar year. This is determined from a process conducted by the Victorian Valuer-General on 1 January each year. So, the 2024 land tax assessment is based on the 1 January 2023 valuation. (good one guys, there’s no way you could make that more confusing).

The 2024 Land Tax year is the first one where all valuations across Victoria are based on the Valuer General assessment. Previously some local councils may have opted to undertake their own valuations. So, if you are in a local government area that previously undertook their own valuations, you might notice a difference in the valuation of your property. More on valuations here: https://www.land.vic.gov.au/valuations/valuations-for-rate-and-land-tax

Objecting to a Land Tax valuation

It’s important to note that you must report errors or omissions in your Land Tax assessment (including objections) within two months of receiving your assessment. More info here.

Vacant residential land tax (VRLT) changes

And another tax to consider is VRLT. VRLT is imposed in addition to standard Land Tax and is based upon the Capital Improved Value of a property. This is usually significantly more than the Site Value (unimproved).

Previously VRLT was only payable on vacant, residential properties in inner-city and ring suburbs of Melbourne. However, from 2025 VRLT will apply to residential land anywhere in Victoria that was “vacant” (not used for more than six months) in the previous year (that is vacant in 2024 for the 2025 VRLT year). Occupation does not need to be a continuous six months provided a property was occupied for an aggregate of 6 months of the preceding year. A “residential” property is land that is able to be used for residential purposes, including properties that have been uninhabitable for two years or more. VRLT does not apply to “vacant land”.

It remains to be seen if VRLT would be applied to “residential” covenanted properties but it remains one to watch … And please keep it in mind if you spend significant amounts of time away from your residential property to visit your covenanted land.

Further information

Trust for Nature has provided the following resources on their website that you may find useful:

- FAQs about TfN covenants including eligible land

- Information on the new Land Tax ruling, including self-funding TfN covenants

- Tax information including Capital Gains Tax, Income Tax, Carbon Farming, Rate rebates.

Land Covenantors Victoria acknowledges the Traditional Custodians of country throughout Victoria and their deep connections to land, water and community. We pay our respect to their Elders past and present and extend that respect to all Aboriginal and Torres Strait Islander peoples today.

Contact: info@landcovenantors.org.au

LCV is a Registered Charity. ABN: 28727715232

Land Covenantors Victoria is a member of the EcoLands Collective - a group of environmental organisations committed to private land conservation, better land stewardship and empowering individuals and communities to leave a living legacy for future generations.